Take Gains, Not Chances

The only trading decision-support platform built on stock market behavior and rules. Sign up for a Full-Access Trial today or join one of our weekly Live Demos.

Winner: Market Structure EDGE

Best Day Trading Software

Use EDGE for Better Entries and Exits

It doesn’t matter how much a stock you own rises if it falls again before you sell it.

However you choose stocks–headlines, screens, personal preferences –what matters is when you buy or sell.

How many times have you been burned by charts, technical signals?

Market Structure EDGE is a decision-support platform that stacks the probabilities of better returns in your favor by shifting the focus from trading PRICE to trading Supply and Demand.

The EDGE is Market Structure

“Market Structure” is the physics of the stock market, the mechanics.

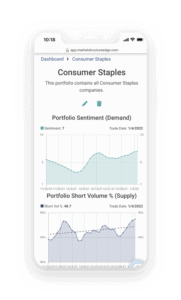

Market Structure EDGE simplifies complex market rules into two core metrics: Sentiment (Demand) and Short Volume (Supply).

- Buy rising Demand, falling Supply, sell the reverse (or if you short stocks, vice versa).

- Add to the probability of profitable trades with sector portfolios that show where all the money is going, all the time. Buy diverging Supply and Demand in the best parts of the market and when the whole market has rising Demand. Reduce exposure when Demand begins to fade everywhere including the broad market.

- Go clear-eyed into the market’s regularly recurring events: Options expirations. Every trader should beware the shoals around monthly options-expirations. Market Structure EDGE gives you risk management predicated on market structure and the trading calendar.

Market Structure EDGE Partners with Interactive Brokers

Market Structure EDGE is excited to announce it has signed a content license agreement with Interactive Brokers, an automated global electronic broker serving over two million online trading accounts.

Read More!

Interactive Brokers, LLC is not affiliated with Market Structure EDGE, and does not recommend or endorse any financial product, service or advice provided by Market Structure EDGE.